Intro: Understanding Property Liens

Title liens can be identified by conducting a thorough title search through public records or by hiring a professional title search company.

If you like to look through public records or have an interest in the workings of your local municipal center, you can perform a title search on your own - but be meticulous.

If you would rather hire a professional dedicated to delivering comprehensive and thorough property title searches, Title Search Direct has you covered!

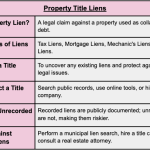

What is a Property Lien?

A property lien is a legal claim against a property. They are typically used as collateral to secure a debt.

Liens can be voluntary, like a mortgage, where the property owner agrees to the lien, or involuntary, such as a tax lien imposed by the government for unpaid taxes.

These liens directly impact property ownership and they must be resolved before a property can be sold or refinanced.

Common Types of Property Liens

Liens come in various forms. Each affects property ownership differently.

These liens are recorded publicly and must be cleared to transfer a clear title.

- Tax Liens: Tax liens are government claims placed on a property due to unpaid taxes. They hold priority over other claims, which can lead to serious consequences like property seizure and sale if left unresolved.

- Mortgage Liens: Mortgage liens occur when a property is used as collateral for a loan. Failure to repay the loan allows the lender to initiate foreclosure and sell the property to recover the debt.

- Mechanic's Liens: Mechanic's liens are claims by contractors or suppliers for unpaid work or materials used in property improvements. These must be resolved before selling or refinancing the property, as they can hinder transactions.

- Judgment Liens: Judgment liens are legal claims resulting from court decisions due to unpaid debts. These liens attach to the debtor’s property and must be cleared before any transfer or refinancing, often affecting all real estate owned by the debtor within the jurisdiction.

Why Conduct a Title Search for Liens?

Importance of Title Searches in Real Estate

A title search is essential in real estate because it uncovers any existing liens or claims on a property.

Without a thorough search, buyers might inherit debts or legal issues attached to the property. Some cases lead to financial loss or litigation.

Title searches provide peace of mind by ensuring that the property is free from hidden problems that could jeopardize ownership.

Additionally, a title search protects buyers from purchasing a property with unresolved legal obligations. It’s a small step that can save a lot of headaches down the road.

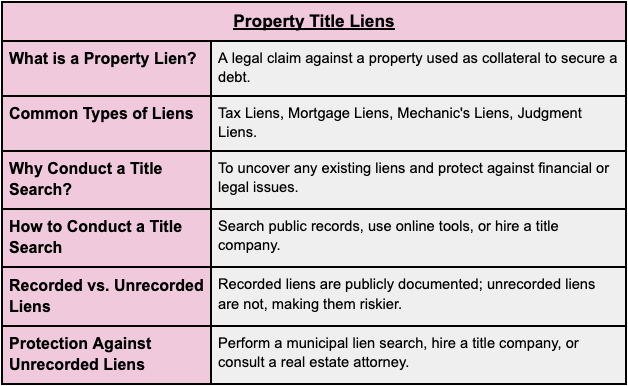

How Title Searches Reveal Liens

A title search involves examining public records to identify any liens or claims against a property. Here's a quick look at the process:

Steps in a Title Search

Steps to Check for Liens on a Property

Searching Public Records

To start your lien search, head to the local county recorder or clerk's office. These offices maintain public records where liens are filed.

Be thorough—accurate information like the property's full legal description and the owner's name will help you find all relevant liens. Double-checking details is key; missed information can lead to unwanted surprises later.

Next, verify the results.

Look for any discrepancies or additional documents that might be linked to the property. Keep in mind that accuracy and completeness are your best friends in this process.

Using Online Tools and Resources

For a quicker search, you can use online tools designed for property lien checks.

Many counties offer online databases where you can access lien information. Additionally, several reliable third-party platforms provide comprehensive lien searches at your fingertips.

- Title Search Direct: Professional service with detailed lien reports.

- County Records Websites: Free access to local public records.

- Third-Party Platforms: Offer broad coverage and user-friendly interfaces.

- DataTrace: Provides access to nationwide property records.

- PropertyShark: Useful for detailed real estate data in urban areas.

Hiring a Title Company

Complex cases may require a professional touch - the same goes for tight schedules or particularly risky properties.

Professionals bring expertise and access to comprehensive databases. They can truly be sure no stone is left unturned.

This approach is particularly valuable if you suspect unrecorded liens or need a thorough search without the hassle. By leveraging their experience, you get a detailed and reliable report that minimizes your risk.

Recorded vs. Unrecorded Liens: What You Need to Know

Understanding Recorded Liens

Recorded liens are those officially filed and documented in public records. They’re straightforward to find through public records or online searches.

Because they are publicly filed, recorded liens are easily flagged during a standard title search.

The Risks of Unrecorded Liens

Unrecorded liens are trickier.

These liens aren't filed in public records and can be harder to detect during a routine title search.

Examples include mechanic’s liens that contractors fail to file or municipal liens for unpaid utilities that don't show up in county records. The risk here is substantial—these liens can unexpectedly surface after purchase and lead to legal and financial headaches.

Go beyond a basic title search to mitigate these risks.

A municipal lien search, for instance, digs deeper into records that aren’t typically included in public databases. It’s an added layer of protection that can save you from future disputes.

How to Protect Against Unrecorded Liens

Protecting yourself from unrecorded liens involves proactive steps - such as performing a municipal lien search. This search covers unpaid taxes, utility bills, and other liabilities that don’t appear in standard title searches.

Key Actions to Protect Against Unrecorded Liens

- Municipal Lien Search: Check for unpaid municipal fees, taxes, and utility bills.

- Hire a Title Company: Professional search to identify any hidden or unrecorded liens.

- Consult a Real Estate Attorney: Legal advice on potential lien issues and unrecorded liabilities.

- Title Insurance: Consider obtaining title insurance to cover any future lien issues.

Final Thoughts: Ensuring a Clear Property Title Nationwide

Thorough lien searches are vital in protecting your property investment. We've covered the steps to identify both recorded and unrecorded liens and emphasized the importance of accuracy and professional assistance when needed.

These guidelines will keep you on the right track, and if you follow them closely, you will be able to rest easy with the satisfaction of a well-informed purchase or a dodged mistake.

At Title Search Direct, we specialize in providing accurate and reliable property title searches in every State. Our expertise and commitment to thoroughness make us a trusted partner in safeguarding your real estate transactions.

If you are worried about a risky property - Title Search Direct will get to the bottom of it!